Tax interest rates

Tax interest is compounded daily and interest rates are reset every 3 months.

Note: Provincial land tax interest rates are not reset every three months. Provincial land tax interest rates are summarized on the provincial land tax webpage. Interest rates do not apply to the Estate Administration Tax Act, 1998.

Current interest rates (April 1, 2025 to June 30, 2025):

- 8% on taxes you owe to the ministry

- 2% on taxes you overpaid

- 5% on taxes or refunds you are eligible for as a result of a successful appeal or objection

- 6% on late International Fuel Tax Agreement payments

- 6% on International Fuel Tax Agreement refunds the ministry has not paid you within 90 days

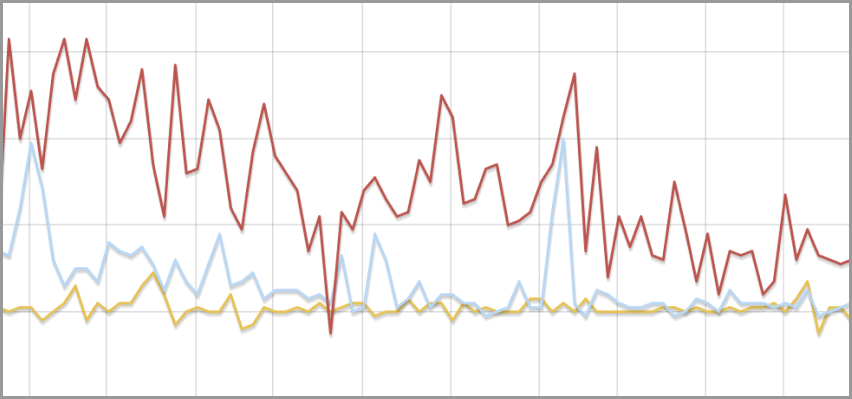

You can download the dataset to view the historical tax interest rates.

Non-Resident Speculation Tax (NRST)

(1) Interest on tax you overpaid begins to accrue 40 business days after a complete NRST rebate or refund application is received by the Ministry of Finance to the date the rebate or refund is paid.

(2) On refunds you are eligible for as a result of a successful appeal or objection of a NRST refund/rebate disallowance, the interest rate is the same rate as though you had overpaid and will begin to accrue 40 business days after a complete NRST rebate or refund application is received by the Ministry of Finance to the date the rebate or refund is paid. Refunds as a result of a successful appeal or objection of NRST that was paid pursuant to a Notice of Assessment, interest will accrue at the higher appeals/objection rate, beginning to accrue from the date of payment to the date the rebate or refund is paid.

Use the data API

Visualize data

Use the Data Visualizer below to display this dataset as a table, graph or map.

Report an issue with this data

Submit a report if you are experiencing issues with the data resources in this dataset.

Data dictionary

| Column | Type | Description |

|---|---|---|

| Effective from / à compter du | Date |

This column shows an effective start date. |

| Effective to / jusqu'au | Date |

This column shows an effective end date. |

| Overpayments- general / paiements en trop - général | Integer |

Retrieving data. Wait a few seconds and try to cut or copy again. |

| Overpayments - appeals / paiements en trop - appels | Integer |

This column shows the tax interest rate, expressed as a percentage, applicable to amounts credited or refunded resulting from certain successful objections or appeals. |

| Underpayments / sous-paiements | Integer |

This column shows the tax interest rate, expressed as a percentage, applicable to the underpayment of select taxes. |

| IFTA | Integer |

This column displays the annualized interest rate for the International Fuel Tax Agreement (IFTA), expressed as a percentage. It applies to any outstanding tax liabilities or refunds not paid within 90 days of receiving the payment request. |

Additional information

- Last updated

- April 1, 2025

- Created

- December 31, 2019

- Format

- text/csv

- File size

- 4.5 KiB

- Licence

- Open Government Licence – Ontario

- Name

- Tax interest rates

- Type

- Data

- Language

- English and French

- Data range start

- April 1, 2025

- Data range end

- June 30, 2025

- Validation status

- success

- Validation timestamp

- 2025-04-01T13:21:34.283415

Help us improve the Data Catalogue

Provide feedback about our data and how you’re using it.