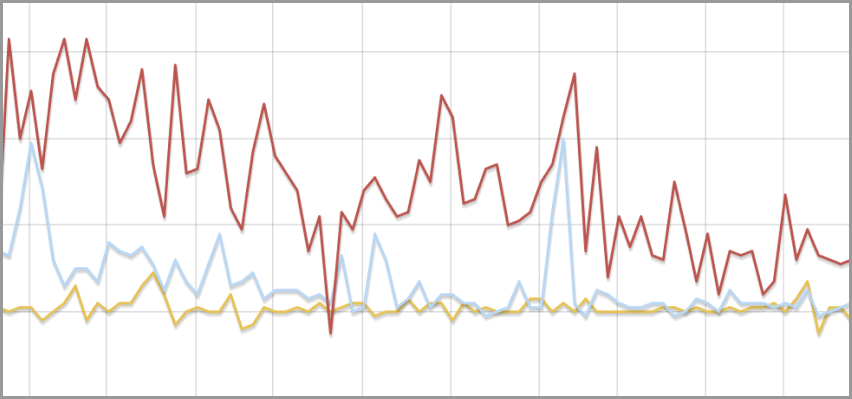

2019-2021

Personal income tax is collected annually from Ontario residents and those who earned income in the province.

The tax is calculated separately from federal income tax. There are 5 Ontario income tax brackets and 5 corresponding tax rates.

For an explanation of these rates and credits, refer to the federal and provincial personal income tax return for the applicable year. To get a copy of the return (also known as a T1) contact the Canada Revenue Agency at 1-800-959-8281 or visit canada.ca/cra-forms.

Read on: about personal income tax

This data is related to:

Related data:

Use the data API

Visualize data

Use the Data Visualizer below to display this dataset as a table, graph or map.

Report an issue with this data

Submit a report if you are experiencing issues with the data resources in this dataset.

Data dictionary

| Column | Type | Description |

|---|---|---|

| 2019 | Text | |

| 2020 | Text | |

| 2021 | Text |

Additional information

- Last updated

- November 25, 2020

- Created

- November 25, 2020

- Format

- text/csv

- File size

- 6.5 KiB

- Licence

- Open Government Licence – Ontario

- Name

- 2019-2021

- Type

- Data

- Language

- English

- Data made public date

- November 25, 2020

- Data range start

- January 1, 2019

- Data range end

- December 31, 2021

Help us improve the Data Catalogue

Provide feedback about our data and how you’re using it.